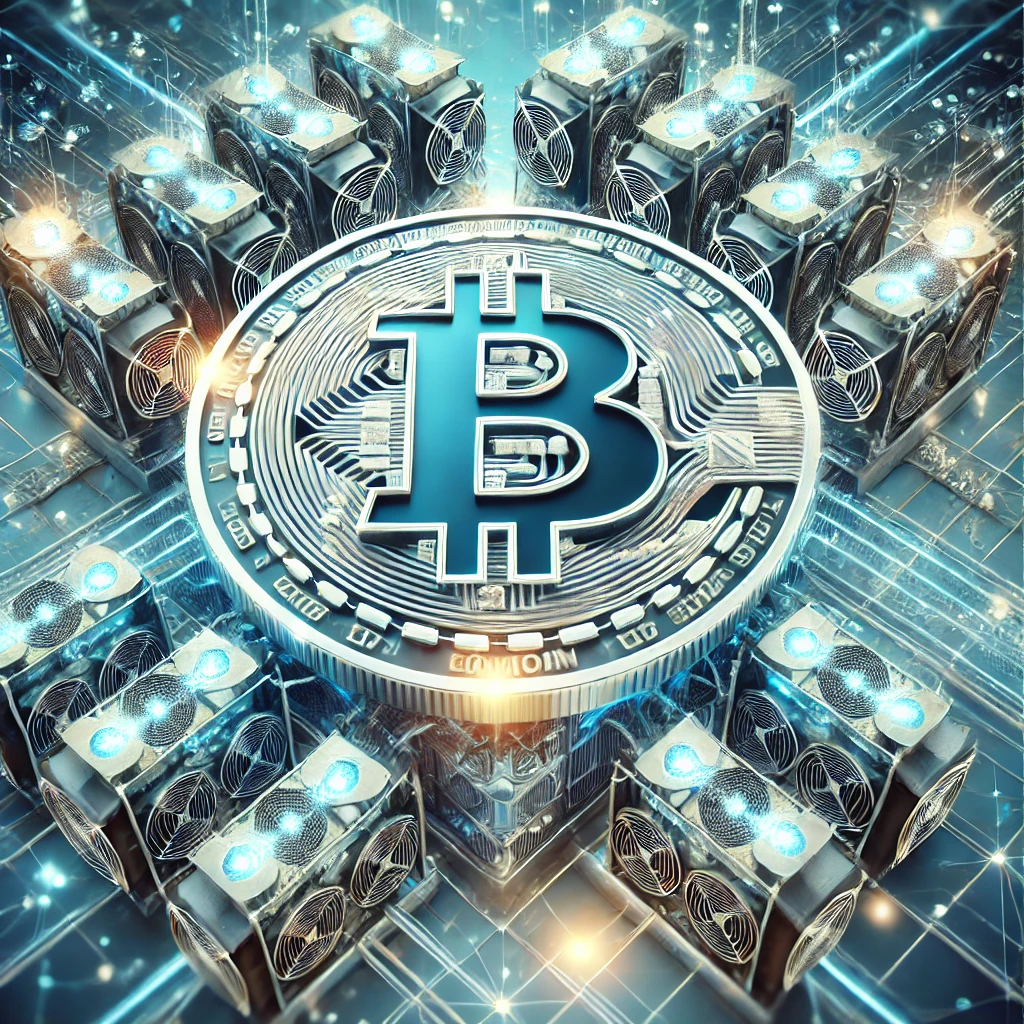

Bitcoin has broken past the $80,000 mark, reaching an unprecedented all-time high. This surge reflects an ongoing trend of increased institutional interest and adoption, positioning Bitcoin as a more mature and mainstream asset class. From hedge funds to major corporations, institutional investors are reshaping the demand landscape for Bitcoin, contributing to its growing price stability and reinforcing its position as “digital gold.”

The Shift in Institutional Perception of Bitcoin

Bitcoin was once regarded as a speculative asset primarily held by retail investors. However, in recent years, large financial institutions have started viewing Bitcoin as a legitimate asset class, often integrating it into diversified portfolios as a hedge against inflation and economic uncertainty. This shift is underpinned by several factors:

- Long-Term Store of Value: Institutions are increasingly treating Bitcoin as a store of value, similar to gold. Bitcoin’s capped supply at 21 million coins has proven attractive to investors looking for protection against inflation.

- Hedge Against Traditional Markets: Given the recent volatility in traditional markets, institutions are investing in Bitcoin as a hedge, diversifying their portfolios with an asset that operates independently of central bank policies and traditional finance.

- Greater Liquidity and Infrastructure: The growth of crypto exchanges, custody solutions, and Bitcoin exchange-traded funds (ETFs) has made it easier for institutions to invest. This has contributed to the influx of institutional capital and has helped increase Bitcoin’s liquidity and market maturity.

Case Example: Pension Funds and Hedge Funds Entering the Market

Several large pension funds and hedge funds have disclosed investments in Bitcoin, citing its appeal as a long-term asset. For instance, prominent asset managers have begun including Bitcoin in their multi-asset portfolios, reinforcing the perception that Bitcoin is no longer a fringe investment but a strategic asset.

The Role of Institutional Demand in Bitcoin’s Price Stability

As institutional investment grows, Bitcoin’s price volatility has begun to decrease, and its market has shown greater resilience. Institutional players generally hold large amounts of Bitcoin, meaning their long-term interest helps reduce market fluctuations and stabilize price swings.

Impact on the Market

- Increased Liquidity and Market Depth: With more institutions buying and holding Bitcoin, liquidity improves, reducing the price impact of large trades and making the market more robust.

- Higher Investor Confidence: The entry of institutional investors lends credibility to Bitcoin, attracting more conservative investors who may have previously been wary of its volatility and regulatory risks.

- Long-Term Value Growth: Many institutions are buying Bitcoin as a strategic asset, meaning they are likely to hold rather than sell. This accumulation supports Bitcoin’s long-term growth trajectory and adds value over time.

What’s Next for Bitcoin as Institutional Adoption Grows?

With Bitcoin now recognized as a valuable part of institutional portfolios, experts predict further growth as more investors turn to digital assets for diversification. As adoption deepens, we may see:

- New Investment Products: Bitcoin ETFs and other regulated products will likely continue to emerge, making Bitcoin accessible to a wider range of investors.

- Further Maturation of the Bitcoin Market: With institutional support, Bitcoin’s market behavior may stabilize, behaving more like a traditional asset with predictable responses to market pressures.

- Potential Path to Mainstream Adoption: As institutional demand grows, Bitcoin’s acceptance as a global store of value may further its reputation as a mainstream asset, ultimately driving broader adoption in both retail and institutional markets.

Conclusion

Bitcoin’s recent rise past $80,000 is more than a price milestone; it signifies Bitcoin’s maturation into a trusted asset class bolstered by institutional demand. As financial institutions recognize Bitcoin’s potential for long-term value and portfolio diversification, the digital currency’s role in the global financial landscape grows stronger, setting the stage for future growth and integration into mainstream finance. For enterprises and retail investors alike, Bitcoin’s evolving status marks an era where digital assets are becoming essential components of modern portfolios.